With the coronavirus pandemic dominating news feeds, it might seem an odd time to think about Brexit. However, for investors it’s important to look ahead and consider how Covid19 could impact something so economically important.

The pandemic has already infected markets and volatility has been severe. In the past two weeks, the FTSE 100 and S&P 500 experienced falls of 16% and 18% respectively (with the main UK index suffering its worst one day drop since 2008). Currencies have also suffered in this time, with the sterling to euro rate falling from around £1.15 to a low of £1.06. Thankfully, new financial stimulus packages and pandemic countermeasures (including the unprecedented UK lockdown) have inspired some confidence and positive movements this week.

Right now, the UK government is focusing on Covid19. However, even though schools are suspended and shops, pubs and restaurants have closed, Brexit is still on course for the end of the year. Since 31st January, the UK has been in a transition period, during which EU laws still apply, allowing negotiators to hammer out the details of a post-Brexit relationship.

However, negotiations have paused, with the pandemic dominating government resources. The chief UK and EU negotiators are also both self-isolating after showing symptoms. What’s more, most EU borders are now closed with international travel severely limited (ironic, given free movement between member states was a sticking point in these negotiations).

Invest for the long term with eToro

Your capital is at risk.

So, what does this all mean for investors?

It’s impossible to predict what will happen, especially with the coronavirus situation changing every day, but it’s clear there’s now less time to negotiate a deal. When Brexit does happen, volatility may also come rushing back as businesses on both sides adjust to this new relationship.

Encouragingly, though, governments are working hard to support economies during this crisis and both the UK and EU will probably want to be in better shape for whenever Brexit happens.

More time could help. Brexit has already experienced several delays, so extending the transition period is possible and the EU has always been open to this. The British public seems to agree, with a recent YouGov poll revealing 55% of Brits are in favour of an extension (with 24% opposed).

It might be significant that the Freight Transport Association, which represents UK logistics, has called for the Brexit transition period to be extended. The FTA said it needed time to “concentrate on the serious issues which the COVID-19 pandemic is placing on the industry”, rather than split resources on figuring out how the UK can continue to physically import and export in the post-Brexit world.

Whether the government listens to these pleas or not, it is clear the virus will have a big economic impact, with some sectors, indexes and currencies coping better than others as we approach B-day.

Therefore, it’s important for investors to look beyond the short-term noise (hard as it is) and consider investment opportunities in the long term – and understanding the impact of Brexit in all this is vital.

Sign up for a free $100k demo account today

- Simply register for free through the button below.

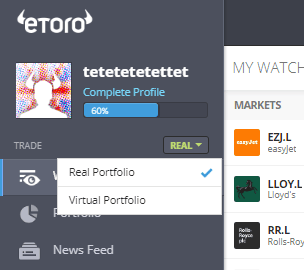

- Once registered, in the top left-hand corner of your account you will see the word ‘Real’. Click this and change it to ‘Virtual Portfolio’.

- You now have $100k of virtual money to trade and invest. Everything you do in this section is not real but follows the live markets as if you we’re investing and trading for real. You will not be charged.

Sign up for a free demo account

Your capital is at risk.