History suggests this oil price crash is a buying opportunity

Commodities tend to be volatile assets and oil — the most actively traded commodity — is no exception. Throughout history, oil prices have risen and fallen, quite spectacularly at times, on the back of changing supply and demand dynamics.

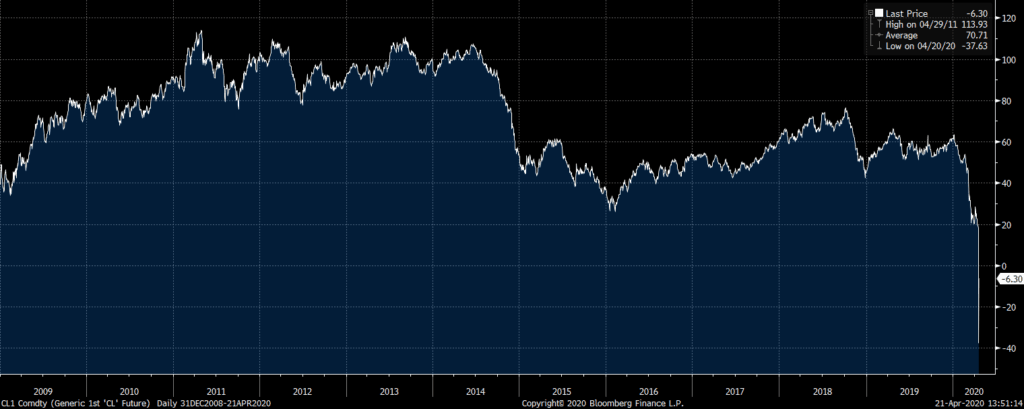

For traders and investors, these oil price movements can present attractive opportunities. This is particularly true when oil prices crash, as they tend to rebound quite quickly. Here’s a look at how oil prices have recovered after dramatic falls in recent decades.

Oil price crashes

Up until the 2000s, oil prices generally remained below $40 per barrel. While they spiked on a number of occasions, including during the 1979 oil crisis and the 1990 recession (briefly rising to $41 per barrel in October 1990 after Iraq invaded Kuwait), the $40 level acted as an area of resistance.

However, all of this changed in the mid-2000s. Due to increasing demand from newly industrialised countries such as China, oil prices shot up dramatically in 2004, rising to nearly $150 per barrel in 2008. Since then, however, we have seen oil prices fall sharply back down below $40 on a number of occasions, despite the fact that the demand for oil is far higher today than it was in the past.

During the global financial crisis of 2008/2009, for example, the price of West Texas Intermediate (WTI) crude oil dropped from around $145 per barrel to around $30 per barrel — a decline of roughly 80% — in the space of less than six months. This fall in oil prices was the result of both a collapse in demand as economies around the world ground to a halt, as well as the unwinding of oil positions by banks, hedge funds, and traders.

Then, between mid-2014 and early 2016 — a period which is often referred to as the ‘Great Oil Bust’ — oil prices experienced another sharp fall. This time, the price of WTI crude oil fell from over $100 per barrel to below $30 per barrel — a decline of approximately 70%. This oil price collapse was the result of both a supply glut and deteriorating demand.

What is interesting about these oil price crashes from a trading or investment perspective, however, is that oil prices did not stay low for very long. On both occasions, oil prices rebounded relatively quickly.

For instance, after the global financial crisis, the price of WTI crude oil rebounded back up to $110 per barrel by April 2011 — a rise of more than 250% in just over two years — on the back of supply cuts and an increase in demand. Similarly, after the Great Oil Bust of 2014-2016, the price of WTI crude oil climbed back up above $70 per barrel by mid-2018 — a rise of more than 130% in just over two years — as supply was reduced and demand increased.

What this historical pattern suggests is that oil price crashes can potentially provide opportunities for traders and investors.

62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Oil price war

This brings us to the current oil price situation. Over the last few months, oil prices have tanked again, with WTI crude oil falling from around $60 per barrel to near $20 per barrel.

This price collapse is the result of two main issues. Firstly, with countries around the world taking unprecedented steps to contain the coronavirus, demand for oil has decreased sharply. According to multinational commodity trading company Trafigura, oil demand could plunge by 35 million barrels per day in the short-term as a result of the coronavirus — roughly a third of normal global output.

Secondly, a price war erupted between Saudi Arabia, the leader of the Organization of the Petroleum Exporting Countries (OPEC), and Russia. In the wake of the coronavirus outbreak, OPEC proposed oil production cuts in a bid to halt the drop in oil prices. Russia was unhappy with this suggestion, however, and said that it would not comply with the production cuts.

In response, Saudi Arabia launched a price war on Russia for refusing to cooperate, making the largest cuts to the price of its crude oil in more than 30 years. It also increased its production, instead of decreasing it as originally proposed. This price war triggered a major collapse in the price of oil, with the price of WTI crude oil falling by 26% immediately after Saudi Arabia’s announcement — the largest one-day crash since the 1991 Gulf War.

An opportunity for traders and investors

While this recent oil price collapse has sent shock waves throughout the financial community (the Dow Jones had one of its worst days ever immediately after Saudi Arabia’s response to Russia), it appears that, with oil back under $30, another opportunity has emerged for traders and investors. Oil now looks very oversold, and if history is anything to go by, oil prices are not likely to stay at this level for very long.

Oil is linked to political stability and at current prices, some countries, including the likes of Russia and Iraq, are going to be impacted negatively. For example, in Russia, oil and gas exports are responsible for more than 30% of the country’s gross domestic product (GDP). This means that it is s in the best interests of major oil producing countries to work together and cut production, in an effort to boost oil prices to a level that raises oil revenues, yet keeps inflation in check.

This is what we have seen recently. On April 13, global oil producers, including Saudi Arabia, Russia, and the US, agreed to a historic oil deal that will see oil production cut by 9.7 million barrels per day. The deal — which will reduce oil supply by about 10% — represents the largest cut in production to have ever been agreed on. The actual production cuts could be much higher than this, however. According to the Saudi energy minister, total cuts could be closer to 19.5 million barrels of oil per day, which would represent around 20% of global supply. Production cuts of this magnitude are certainly likely to help stabilise the price of the commodity in the near future.

Of course, given the economic uncertainty associated with the coronavirus outbreak, we have no way of knowing how long it will be before oil prices rebound if at all. Economic activity could potentially be subdued for a while. However, the current oil price crash does have some similarities to the one which occurred during the global financial crisis and it is interesting to see how oil prices recovered there.

Eventually, the world will recover from the coronavirus and economic activity will pick up again. And when this happens, oil prices are likely to recover as well. That is why now could be a good time to increase portfolio exposure to oil. With oil prices currently under $30 per barrel, the risk/reward proposition looks attractive.

62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.