Keen to trade stocks on the Australian stock market but are not sure how it all works? Getting a handle on the ASX is a great place to start. This guide will introduce you to the basics of the ASX and the ASX 200 (AUS200), the role this exchange plays in the Australian stock market, some of the companies that help make up this foundational piece of the Aussie trading landscape and some of the basic steps for getting involved.

Getting to know the ASX

The Australian Securities Exchange, also known as the ASX, is the result of the combination of multiple independent exchanges across Australia. In 1987, Parliament passed legislation that combined the independent stock exchanges of six states to become the Australian Stock Exchange. But the ASX as we know it, was completed in 2006, when the Australian Stock Exchange and the Sydney Futures Exchange came together to form what we now know as the Australian Securities Exchange, which is located in Sydney.

The ASX in Australia is similar to the New York Stock Exchange (NYSE) in the United States or the London Stock Exchange in England. While it features thousands of listed companies, it is perhaps best-known for the ASX 200.

What is the ASX 200?

The ASX 200, also known as the S&P/ASX 200, is a collection of the top 200 publicly traded companies listed on the ASX in terms of market capitalisation. Market capitalisation is determined by multiplying a company’s share price by its number of shares.

What is the ASX 200 used for?

Much like the S&P 500 (SPX500) in the United States, the ASX 200 acts as a market index. A market index can be considered a snapshot of a market or exchange. Measuring how well the top 200 listed companies on the ASX are doing, gives traders a data point they can use to understand how the market is doing overall. The performance of ASX 200 companies with larger market capitalisation, will have a greater impact on the index rising or falling.

What does it take to be listed on the ASX 200?

Generally there are three main factors that go into being part of the ASX 200:

- A company has to be publicly traded on the ASX 200.

- The company has to meet liquidity requirements, which means it has to have a certain number of shares available for trade by a wide number of potential investors.

- It must have a market capitalisation that ranks in the top 200 of the ASX.

Every three months, an audit is conducted to reorganise the ASX 200 as needed.

Some of the top companies regularly listed in the ASX 200 are:

- The ‘big four’ banks — Commonwealth Bank (CBA), Westpac (WBC), ANZ (ANZ) and NAB (NAB).

- Materials and resources companies, including BHP (BHP) and Rio Tinto (RIO)

- Telecommunication companies such as Telstra (TLS) and TPG (TPM)

- IT companies, including Xero (XRO) and Afterpay (APT)

- Other household names including Woolworths (WOW) and Coles (COL), Macquarie Group (MQG), Coca Cola Amatil (CCL), Domino’s Pizza (DMP) and more.

What makes the ASX 200 rise and fall?

Since the value of the ASX 200 is calculated by combining the value of the shares of the companies on the list, the same things that cause shares to go up and down in price also cause the ASX 200 to change. Each company’s value to the index is relative to its total market value or ‘market capitalisation’ — a number determined by the share price multiplied by the number of shares outstanding. The ASX 200 is market capitalisation-weighted and float adjusted (meaning: it does not include restricted shares), so companies with the largest total market value will have a greater influence on the index’s value.

Some of the factors that can cause this fluctuation of share price and, therefore, of the ASX 200, can include, but are not limited to, natural disasters; positive or negative quarterly, half-yearly or annual reports, especially from companies with larger market capitalisation and, therefore, more weight in the index’s value; changes in interest rates as determined by the Royal Bank of Australia; and the value of Australia’s major exports.

What can you buy and sell on the ASX?

You can buy and sell shares of any of the 2,000-plus listed companies on the Australian Securities Exchange, including the ones that have earned a place in the ASX 200. While you can buy shares in any individual company, one way to invest in the ASX 200 more broadly is through an Exchange Traded Fund or ETF. This generally means you invest in the ASX 200 as a whole by spreading your investment across a number of the companies found in the list. There are different ETFs to choose from that spread your investment across different sectors, company sizes and growth rates, among other factors. While it is not guaranteed, some traders find investing in an ETF to be safer than picking and choosing which ASX 200 companies to invest in individually.

Another option for investing in the broader ASX 200 index is through the AUS200 CFD. CFDs or ‘Contracts for Differences’ involve engaging with a contract broker to speculate on the underlying movement of an asset, while not owning the asset itself. This method of trading indices provides the opportunity for you to trade in both directions, whether you believe the index will rise or fall. There are also options for leveraged trading, which can yield greater rewards but also has greater risks.

Please note, eToro currently only offers investing in the AUS200 CFD.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

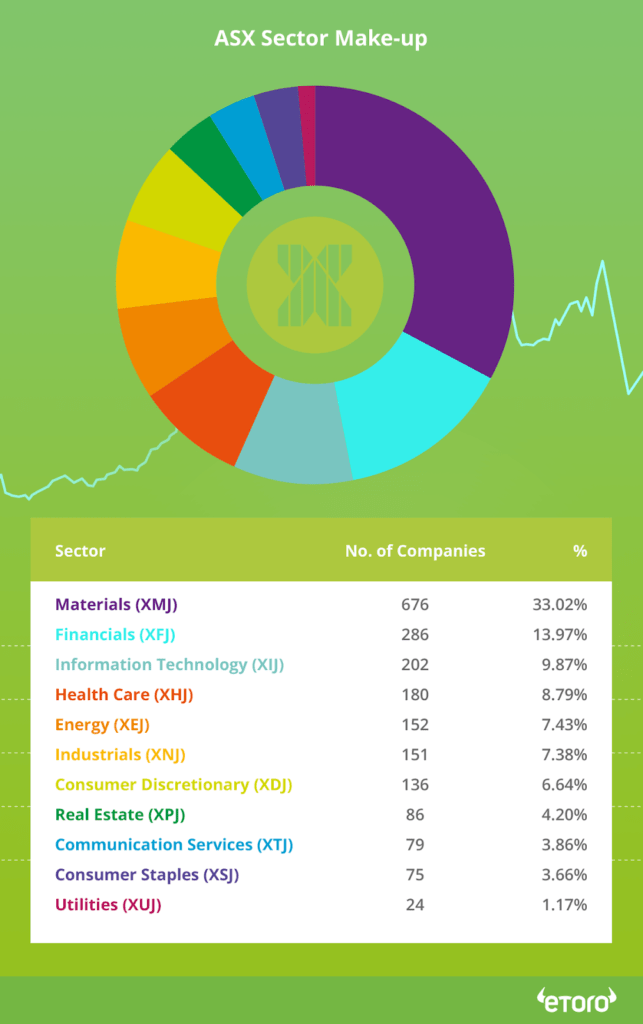

What is the sector makeup of the ASX?

Companies that are traded on exchanges like the ASX are grouped into sectors, often determined by the Global Industry Classification Standard (GICS). Some of these sectors are then broken down into industry groups, which helps sort the businesses within each sector even further. These classifications allow investors to easily search and sort companies to see how they are not only performing compared to each other, but also how entire sectors are performing.

The ASX features companies from 11 sectors and 24 industry groups:

- Materials

- Financials

- Banks

- Diversified Financials

- Insurance

- Information Technology

- Software & Services

- Technology Hardware & Equipment

- Semiconductors & Semiconductor Equipment

- Health Care

- Health Care Equipment & Services

- Pharmaceuticals, Biotechnology & Life Sciences

- Energy

- Industrials

- Capital Goods

- Commercial & Professional Services

- Transportation

- Consumer Discretionary

- Automobiles & Components

- Consumer Durables & Apparel

- Consumer Services

- Media

- Retailing

- Real Estate

- Telecommunication Services

- Food & Staples Retailing

- Food, Beverage & Tobacco

- Household & Personal ProductsConsumer Staples

- Utilities

Each company on the ASX is assigned to one of these sectors upon listing.

Do you need a broker to trade shares on the ASX?

While you do not need a broker to trade shares on the ASX, some investors find it easier to do so with the help of an experienced professional.

Here’s a breakdown of some of the most popular methods for trading on the ASX:

Full-service broker

Full-service brokers are firms or individuals who more or less do your trading for you. They help you determine your goals and interests with regards to trading so they can then make investments on your behalf. Often, a full-service brokerage will be a more expensive option, with fees for each trade. But this can be good for those with little time to study the market and trade.

Online broker

An online broker is usually more a platform than an actual person you deal with. These platforms, which can usually be accessed via the web or through an app, put the world of investing at your fingertips. Each online broker will have different features, such as eToro’s CopyTrader that lets you copy the investments of popular global traders, as well as different available markets such as stocks, currencies, cryptocurrencies and more. Online brokers can be excellent options for those who want to be more active and have quick access to trading.

Without a broker

There are also ways to buy ASX shares without going through a broker. One way is by investing in a managed fund that consists of stocks on the ASX 200. Your money will then be used by a fund manager to buy stocks based on the type of fund you’ve chosen. Another way is through the company you work for, which might offer shares of the business to its employees. You can also get your hands on shares sometimes through crowdfunded initial public offerings (IPOs), where you buy straight from the business itself.

Buying, selling and investing in the ASX

Here’s a basic guide on how to buy shares on the ASX in Australia. You can invest in the AUS200 CFD on eToro through the below steps.

- Choose your trading platform. As mentioned above, the first step to getting involved is finding the method of buying, selling and trading that works best for you.

- Start an account. Depending on your platform, this can mean everything from meeting with and making a plan with a full-service broker to creating a profile with an online broker.

- Choose which ASX shares to buy. Whether you’ve done a lot of research, want to leave it up to your broker, want to copy the moves of a Popular Investor or simply want to invest in companies you like and use every day, here’s where you make your selections. Note: It’s important to do some budgeting first with regards to how much you want to invest. Under no circumstances should you invest money you cannot afford to lose.

- Decide how many shares to purchase. This can depend on several factors, some of the most important of which are how much money you have to invest, your investing goals and the share price of your chosen companies.

- Buy or invest. Confirm your trade!

-

- Monitor your investment. You should always monitor your investment whether you are trading on a platform, using CopyTrader or letting someone else manage your money. If you are wanting a less hands-on approach, our CopyTrader feature may help with Popular Investors providing regular updates about their investments. You can also stay updated at all times with our 24/7 real-time share values with just a few taps. You can even sign up for announcements and alerts from the companies in which you have invested.

When does the ASX open?

Is the ASX open today? If it is Monday-Friday between 10am–4pm Australian Eastern Daylight Time (the time zone in which its Sydney headquarters resides, then the answer is usually going to be yes. ASX trading hours follow general working hours pretty closely.

On normal days, there is also a pre-opening period from 7–10am, when brokers and investors can enter trades online to be completed upon the market opening.

And as with general working hours, the ASX is closed for a range of public holidays:

| Holiday | Trading availability |

| New Year’s Day | Closed |

| Australia Day | Closed |

| Good Friday | Closed |

| Easter Monday | Closed |

| ANZAC Day | Closed |

| Queen’s Birthday | Closed |

| Final Business Day before Christmas | Closes Early |

| Christmas Day | Closed |

| Boxing Day | Closed |

| Final Business Day of the Year | Closes Early |

Trading on the ASX can be a great way to get involved in the world of investing. eToro can help you buy and sell 0% commission ASX stocks along with thousands of other assets.

Get started on eToro.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.