Will BlackRock’s Bitcoin fund be approved?

The crypto market has posted a strong finish to the second quarter, with Bitcoin staying buoyant above $30K even as BlackRock’s ETF application hits a speed bump.

Elsewhere, Bitcoin’s closest cousins Litecoin and Bitcoin Cash are leading the altcoin market higher with double-digit gains on increased regulatory clarity. As eToro Global Strategist Ben Laidler points out, this confidence derives from listings on Citadel-backed EDX Markets’ exchange, but also the signing of a UK finance bill into law “classifying crypto as a regulated activity, and the EU publishing a legal framework for a digital euro”.

Read more after the jump.

This week’s focus

– Bitcoin holds above $30K as ETFs hit speed bump

– Compound up 66% in DeFi rally

– Halving hopes help Litecoin breach $100

– Bitcoin Cash boosted 27% by tailwinds from South Korea

BTC continues to push above the previous resistance level of $30K

Bitcoin remains perched comfortably above $30K, even amidst regulatory headwinds.

Last week, The US Securities and Exchange Commission (SEC) said that BlackRock’s Bitcoin exchange-traded fund (ETF) application was “inadequate”, and requested more information about proposed mechanisms for deterring fraud and manipulation.

Nevertheless, the SEC did approve the first US-based leveraged Bitcoin futures ETF, which opened to investors on Tuesday.

Plus, hopes still remain high for BlackRock’s application, which includes a “surveillance-sharing agreement” designed to address SEC concerns.

Commenting on the application, Bloomberg Senior ETF analyst Eric Balchunas said that BlackRock’s ETF refusal could be more of a speedbump than a stop sign, and that requests for more specificity about the details of the application could be taken as “arguably good news”.

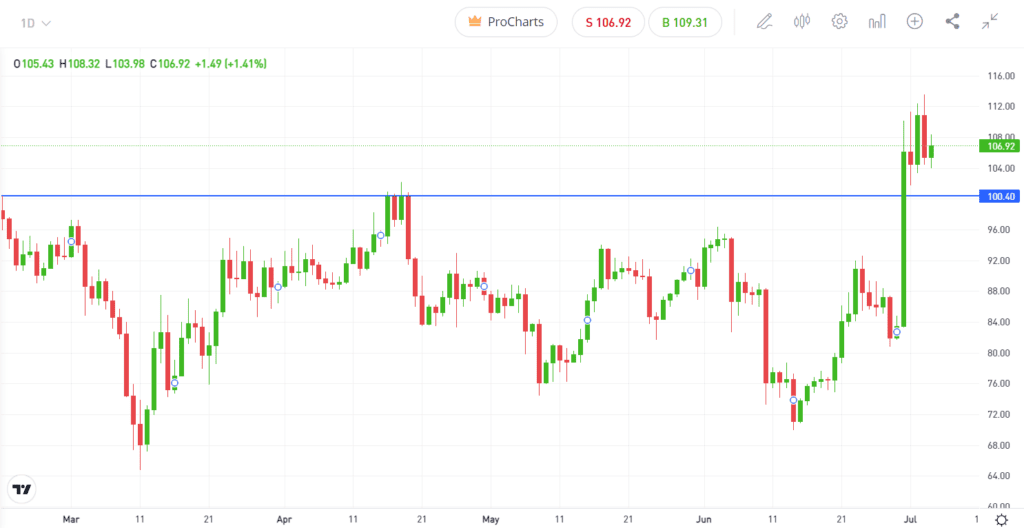

Halving hopes help Litecoin breach $100

LTC surged +26% on Friday, slicing straight through resistance at $100

After months of nudging against $100, Litecoin has broken through this key psychological level.

One reason for the breakthrough could be that Litecoin was one of only four cryptoassets chosen by Citadel Securities and Fidelity-backed EDX Markets to trade on its exchange. This is thought to be due to relatively high levels of regulatory clarity, as the altcoin wasn’t referred to as a security in recent action by the US Securities and Exchange Commission (SEC).

In addition, Litecoin is also due for its “halving” next month, which will effectively reduce the supply and make the asset more scarce: “Litecoin is under 5 weeks away from its halving, taking place on August 3” wrote on-chain analytics firm Santiment in a recent research note. “Prices have suddenly soared for LTC, blasting off for +26% in just over a day. Watch for mainstream FOMO, as this usually foreshadows local tops until crowds calm down.”

Bitcoin Cash boosted 27% by tailwinds from South Korea

After weeks of sideways price action, BCH has exploded almost 200% in the last ten days

Racing alongside Litecoin, Bitcoin Cash is also benefiting from the regulatory clarity conferred by its Citadel-backed EDX Markets’ exchange listing.

Most of the trading volume driving the rally appears to be from South Korea, where Bitcoin Cash volume in Korean won has soared to more than five times the equivalent in the US, according to data from Coingecko.

Commenting in last week’s newsletter, Lawrence Lewitinn from crypto data provider the Tie explained that the positive sentiment was driven by confidence that “Litecoin and Bitcoin Cash, as derivatives of Bitcoin, were not securities.”

In addition, a recent network update could also be catalyzing interest in the cryptoasset. Bitcoin Cash underwent a significant upgrade in May, improving security and privacy while laying the groundwork for a forthcoming upgrade that will add the ability to use tokens on the blockchain.

Compound adds 66% to lead DeFi gainers

COMP is at the top of the range it has traded in for the last year

DeFi continues to sprint ahead of the broader market, with Maker and The Graph both making 20-30% gains in the past week

The standout performer, however, is Compound. The token of the decentralized lender surged 66% over the last week, which may be driven by anticipation of a new company launched by Founder Robert Lesher.

Dubbed Superstate, the venture will bridge Tradfi and DeFi by creating a short-term government bond fund and using Ethereum as a secondary record-keeping tool.

While Leshner didn’t announce a role for the Compound token in the project, the announcement sparked widespread speculation about the possibility, and big players appear to be taking notice.

According to onchain analytics firm Lookonchain, the rising prices accompany the movements of a big investor, and “the rise in the price of $COMP may have something to do with this whale.”