Before you can make any returns from the financial markets, you need to understand what type of investor you are. Acknowledging this will encourage you to invest in a way that will best help you to meet your financial goals. Learn about the differences between active and passive investing, and how risk tolerance can impact your investments.

Discover which type of investor you are

The financial markets can sometimes appear overwhelming, but there are thousands of different investment products that have been developed to meet the individual needs of investors. For new investors, it is normal to spend some time filtering down stocks, bonds and other financial assets into a shortlist of instruments that meet your personal investment aims and style.

The most important quality for an investor is temperament, not intellect.

Warren Buffett

Active vs passive investors

Investing can basically be split into two distinct categories: active and passive. There is a huge difference between active and passive investing, and deciding which investment style best suits you is one of the major decisions that new investors need to make.

Active investors use financial news reports, price charts and expert opinions to identify trading opportunities. On the other hand, passive investors tend to take a more hands-off approach, relying on the fact that assets, such as stocks, have traditionally generated inflation beating returns in the long run. Put more simply, active investors believe that they can beat the market, whereas passive investors prefer to track the market’s overall performance.

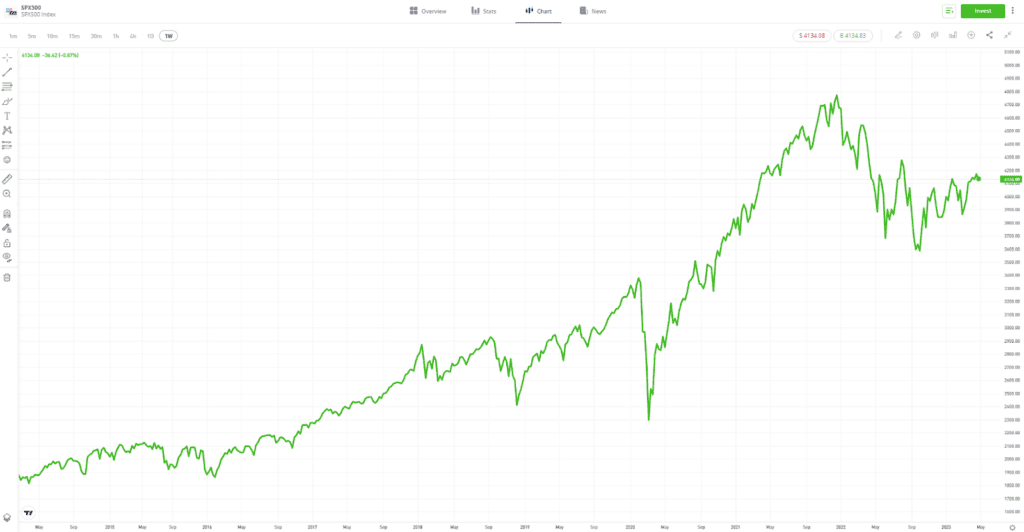

| S&P 500 Index 2014–2023 (+125% Return) |

Past performance is not an indication of future results

Source: eToro

Tip: Establishing whether you want to, or have the time to, adopt an active approach is the first step towards forming a realistic investment plan.

Other types of investors

There are plenty of investment approaches available to both active and passive investors. Not all approaches will be suitable for every type of investor, so it is important to understand the differences between them before committing to a particular style.

Value investors

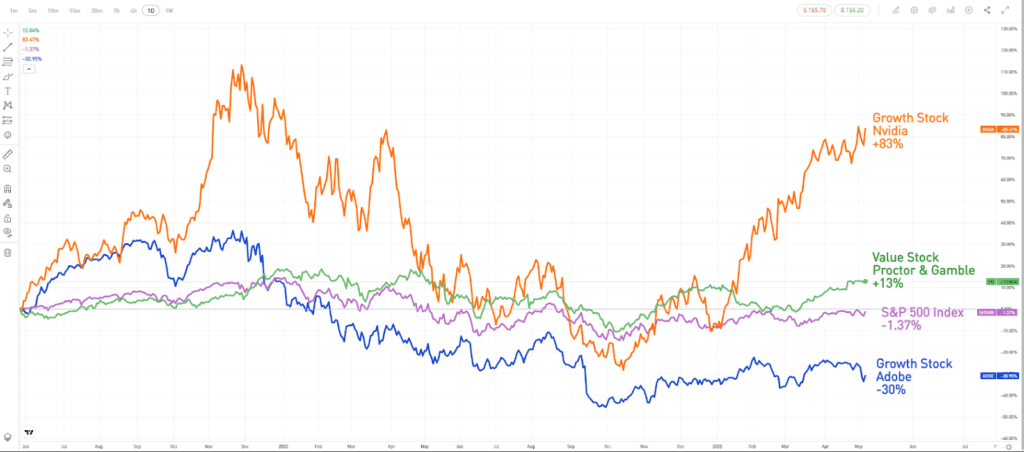

Value investors use fundamental analysis tools to locate assets, such as stocks, that they believe are being mispriced by the market. Buying “cheap stocks” can potentially generate market-beating returns if the rest of the market comes to appreciate the real potential of a company over time.

Growth investors

Most stock valuation models use forecasts of future earnings to establish what the current price of a stock should be. Firms that are expanding into new markets, or are due to release innovative new products, could potentially outperform expectations which would result in the stock price rallying.

Income investors

Owning certain financial instruments will result in investors being paid a regular income. For example, bondholders receive coupons, and some stocks pay dividends. This income can be reinvested or used to finance lifestyle commitments.

Momentum investors

It is possible to make investment returns by identifying the moment that price trends form, rather than taking a view on whether or not an asset is already fairly valued. For example, day traders use technical analysis to buy or short sell assets, with the intention of exploiting short-term pricing anomalies.

Index investors

Indices are instruments that track the performance of a group of assets with similar characteristics. For example, the S&P 500 Index is made up of the largest 500 stocks listed on US exchanges. Buying an index can allow investors to passively follow the returns of the broader market.

Tip: Indices are often used as benchmarks of market performance. An active investor might try to beat the returns posted by the S&P 500 Index, whereas a passive investor might just buy the Index.

In the chart below, it is possible to see the relative performance of four different assets over a period of 24 months.

Past performance is not an indication of future results

Source: eToro

Risk tolerance and investing

Understanding your risk tolerance from the outset can better help you to stick with your investment plan. It is always important to develop the right investment mindset, but if your portfolio has a risk-profile that does not suit you, then, any market uncertainty might lead to emotional investing.

Conservative investors

Conservative investors prioritise capital preservation, targeting low-risk investments and using diversification to manage risk. This approach is often more popular with investors who are nearing retirement age, as there is less scope for them to recoup any short-term losses.

Moderate investors

Moderate investors adopt an approach that balances risk and return. This can be achieved by building a portfolio of different asset classes, such as bonds, currencies, commodities and stocks.

Aggressive investors

Investors interested in significantly increasing their capital will need to scale up on risk-return. This investment approach could involve using leverage and lower levels of diversification, for example. An aggressive investment portfolio could also be weighted towards higher risk asset classes, such as growth stocks, commodities and cryptoassets.

Tip: Active investing is not guaranteed to generate above-market returns. There is risk-return involved, and some actively managed portfolios will underperform the portfolios of passive investors tracking the wider market.

Final thoughts

Establishing your investment aims, risk tolerance, and the amount of time you can devote to managing your portfolio are some of the golden rules of investing. Moving forward, you can identify and trade financial instruments that fit in with your strategy and risk tolerance.

Visit the eToro Academy to learn how to build a portfolio that suits your style.

Quiz

FAQs

- What assets should a passive and conservative investor buy?

-

Passive and conservative investors tend to prioritise capital preservation. This approach would involve buying lower risk instruments and diversifying capital across different positions to manage risk. For example, exchange-traded funds (ETFs) are fund-style products that naturally have some diversification built in. They can also be bought and sold at any time.

- Should I consider changing my approach to risk?

-

There could always be a need for investors to adjust the levels of risk-return on their investment portfolio, especially as market conditions or personal circumstances change. However, it can be hard to predict when the markets might crash or price volatility might change, so investors often prefer to create a portfolio that reflects their underlying approach to risk. This can make it easier to stick to a long-term strategy when the markets inevitably move up and down.

- How can I be sure my investment portfolio suits my aims?

-

When building a portfolio, it is important to consider what kind of percentage return you want to make and how long you are willing to wait to achieve this return. In addition, investors need to understand the consequences of not achieving their goals or losing some of their capital. If you are still unsure, using a demo account to trade with virtual funds is a good way of understanding what to expect when you invest real money.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.