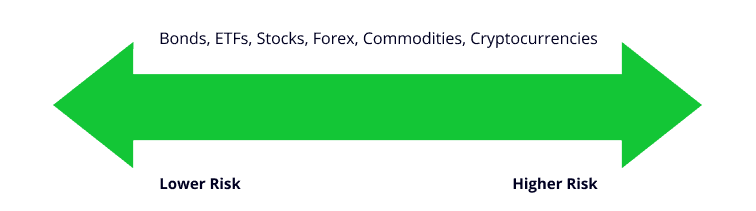

Financial assets can be broken down into different categories, with popular asset classes including stocks, bonds, indices, funds, commodities, currencies and cryptoassets.

Spreading your capital across different asset classes will help to diversify your portfolio, which, in turn, can help to manage risk and smooth out overall returns. If one asset class is underperforming at a given time, it could potentially be balanced out by one that is outperforming. The long-term aim of portfolio diversification is that your positions in each asset class are given enough time to generate the returns that your strategy predicts.

Discover the different asset classes, what they involve and why they might be a good option for helping to diversify your portfolio.

Choose the Right Asset Class for Investing Success

Tip: What are asset classes? An asset class is a grouping of investments that have similar characteristics. They typically react to market events in a similar way and will largely be subject to the same rules and regulations.

What asset classes should you invest in?

Picking your first investments and deciding where to invest your money in the future can be difficult, but understanding the different asset classes available to investors will help you to decide the right investment pathway for you.

Each asset class can have positive and negative attributes and will experience different kinds of price moves as market conditions fluctuate over time.

What types of Financial Asset Classes are there?

Stocks

Stocks typically make up a large part of a well-balanced investment portfolio. They allow investors to take part ownership in a company such as Apple Inc, C3.ai Inc or Barclays.

If a company performs well, or is expected to perform well, investors will buy shares in the company to gain a percentage of future profits. This should, in turn, then drive the price of the stock upwards. On the other hand, if a firm is considered to be underperforming, and investors sell their shares, their price will fall.

Trading in stocks is widely considered to be less complicated and more cost-effective than other asset classes, which is another reason behind their popularity. It is not uncommon for investors to allocate the majority of their capital to stocks.

Indices

Indices are stock indexes that measure the performance of a particular group of stocks over time.

In the US, the Dow Jones Industrial Average is one of the most popular examples of an index. It tracks the price of 30 of the largest, publicly owned companies trading on the NASDAQ and the New York Stock Exchange. The NASDAQ 100 and the FTSE 100 are two other well-known indices, focusing on the 100 largest firms listed on the Nasdaq and London Stock Exchange respectively.

Indices offer a convenient way to gain exposure to the prospects of similar kinds of stocks, without needing to invest in them individually.

Developing a better understanding of the characteristics of the different asset classes will help you decide which blend of investment opportunities suits your risk tolerance.

ETFs

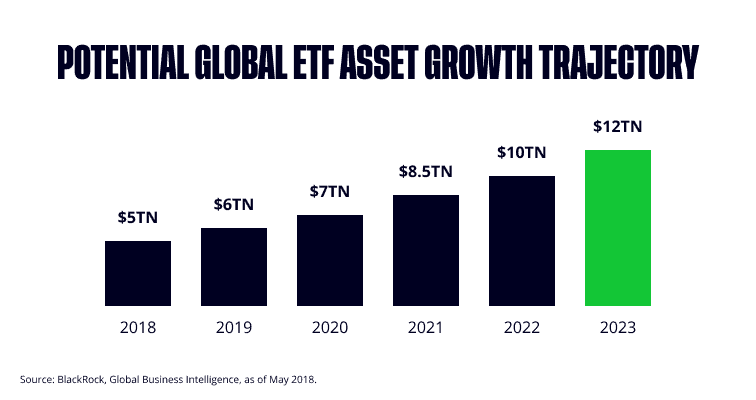

Exchange-traded funds (ETFs) are an asset class that is popular with beginner investors. Similar to indices, ETFs are fund-style in nature, with the underlying assets being grouped together by sector or asset type.

ETFs offer a way to invest in a range of assets, from emerging market stocks (EEM) to US Government bonds (TLT) and the health care sector (XLV). The functionality of exchange-traded funds makes them a user-friendly and cost-effective option for new investors.

For illustration purposes only. Past performance is not an indication of future results.

Source: BlackRock

Tip: If you want to invest in an asset class, but can’t identify specific targets, a fund-style product will allow you to buy a basket of instruments within that group.

Commodities

Commodities are the raw materials purchased by manufacturers to drive global industrial output. Oil, wheat and copper are just some of the commodities traded on international exchanges, with the price fluctuating according to supply and demand.

If you believe that a particular geopolitical situation will result in the price increase of natural gas, for example, you could consider buying a position in natural gas through your broker.

Currencies

The currencies of different countries are always changing in value. Some of these trends can be long-term in nature. For example, if a country is seen as a growth market, an influx of investors and corporations in that country will likely cause the price of the currency to fluctuate. Currencies can also increase or decrease in value as a result of geopolitical events, among other factors.

Currency trading, forex trading and foreign exchange trading are all terms that explain the process of trading in a currency asset, in the belief that its value is due to change.

Cryptoassets

Cryptoassets, such as Bitcoin, are digital assets or currencies on a blockchain. Because the sector is still in its infancy, volatility, and, therefore, price swings, can be extreme. As a result, cryptoassets are high on the risk-return spectrum, but historical price moves have made them an interesting option for investors.

Tip: An asset class that is generally considered to be low-risk, can contain instruments that are high-risk, and vice versa.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

Bonds

Bonds, or fixed-income products, are assets that involve one party loaning capital to another. Governments or corporations that need to raise funds can act as the borrower, or bond issuer. The borrower will offer a fixed return over a set period of time, which could be months or years.

For investors, bonds do hold some risks, for example, if the bond issuer goes bust or can’t pay back the loan. This risk is usually reflected in the interest rate offered —– the higher the risk, the higher the rate.

Tip: Investments in more stable asset classes, such as bonds, can smooth out the overall returns of your portfolio. This can create room for a smaller percentage of capital to be invested in asset classes with a higher potential risk-return.

Final Thoughts

Developing a better understanding of the different asset classes and their specific characteristics will help you to decide which blend of investment opportunities suits your risk tolerance. Picking investments to diversify your portfolio can help you to manage risk, ride out short-term volatility and make long-term gains that offer a potential route to financial freedom, whatever that looks like to you as an investor.

Visit the eToro Academy to learn more about how different asset classes perform in various market conditions.

Quiz

FAQs

- How do I diversify my portfolio?

-

Portfolio diversification involves more than just buying a greater number of smaller positions. If all of the assets you own have similar characteristics, then, any price moves will most likely be reflected across your portfolio. Diversifying your portfolio involves investing in a range of assets that you believe will ultimately increase in value, but that may take different routes to achieving their individual targets.

- How long do I have to hold a position in different asset classes?

-

Different asset classes have different characteristics. If you are looking to invest for short-term gains, then instruments with lower volatility may be a better fit, as there is less chance of their value moving much lower or higher than you would like it to. The longer your investment time horizon, the wider the choice of asset classes you can invest in while still maintaining a sensible approach.

- Am I ready to start investing?

-

Successful investing requires an understanding of your aims, the assets and markets you are investing in, as well as the key terms associated with investing. In addition, investors should have a clear plan on how to achieve these goals. There are many other aspects of the financial markets you can study to strengthen your position, but if you have satisfied those core principles, you should be ready to start investing.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.