TRADE OPTIONS.Earn 3.9% on cash*

Experience the power of options trading on an easy-to-use interface.

*Terms apply, rate subject to change. For residents of NY, NV, HI, Puerto Rico, and US Virgin Islands, see here for location-specific details.

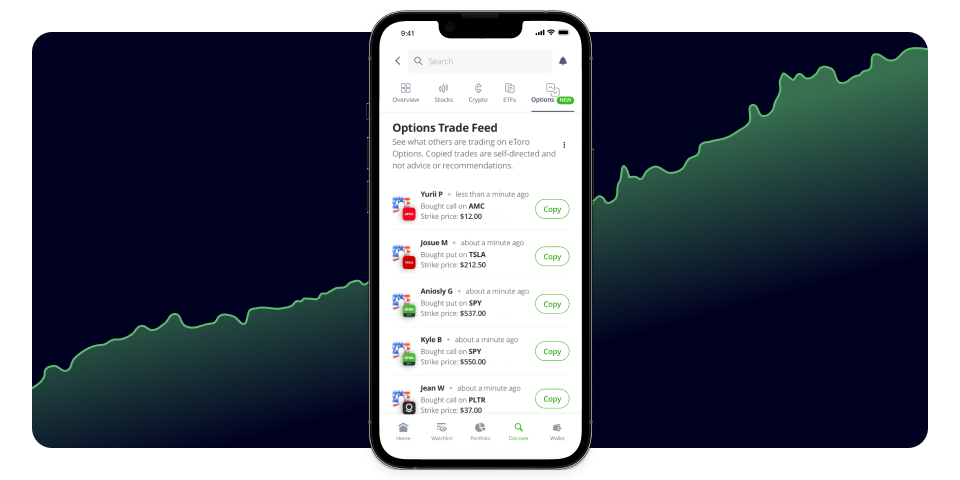

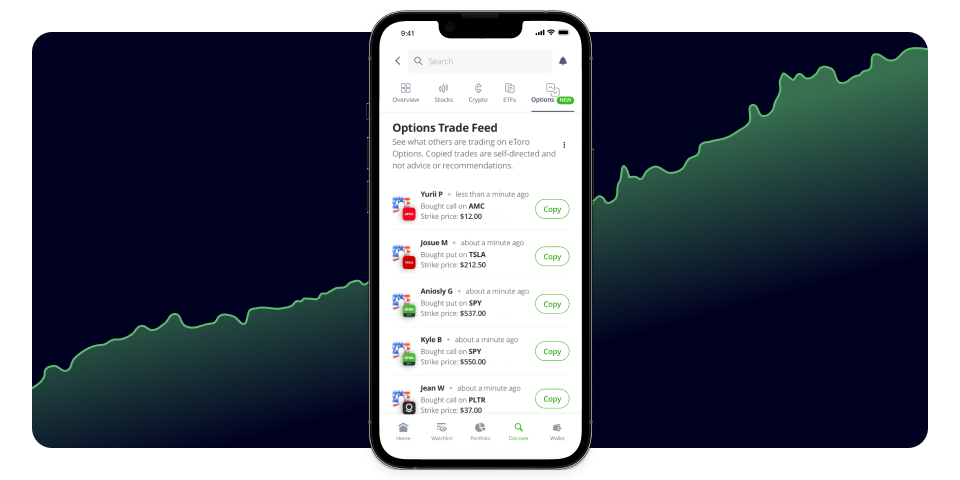

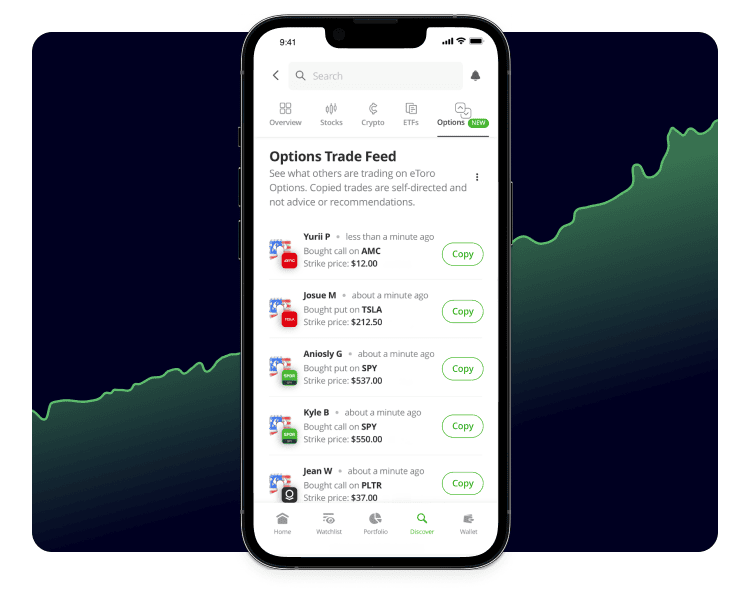

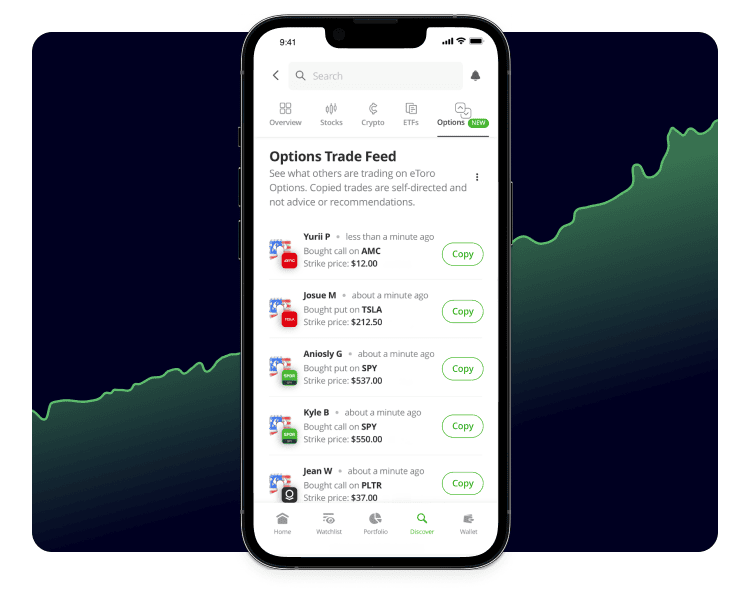

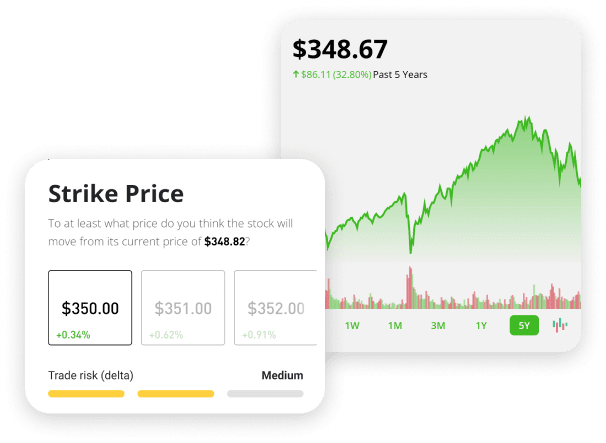

See the world like a trader

With an app built for the modern world, eToro puts the power of options trading in the palm of your hand — all while simplifying the process for beginners and experts alike.

- Access to leverage-based trading, without all the jargon

- Visibility into others’ trades via a social feed

- ZERO commission or contract fees*

- Opportunity to earn 3.9% interest**

*No contract fees refer to per-contract fees that are charged at some major brokerages. Regulatory fees still apply to options trades. For certain services on your brokerage account, we may also pass along a processing fee charged by our clearing firm. Please refer to our Fee Schedule for a complete listing of relevant charges.

**Fee subject to change, T&Cs apply. For residents of NY, NV, HI, Puerto Rico, and US Virgin Islands, see here for location-specific details.

How to get 3.9% annual interest on cash

Sign up for eToro and open an options account

Transfer money to your options account

Sign up for the interest on cash program

*Please note: You must qualify for an options account in order to access this offer. This qualification is based in part on your risk tolerance and investment goals. For residents of NY, NV, HI, Puerto Rico, and US Virgin Islands, see here for location-specific details.

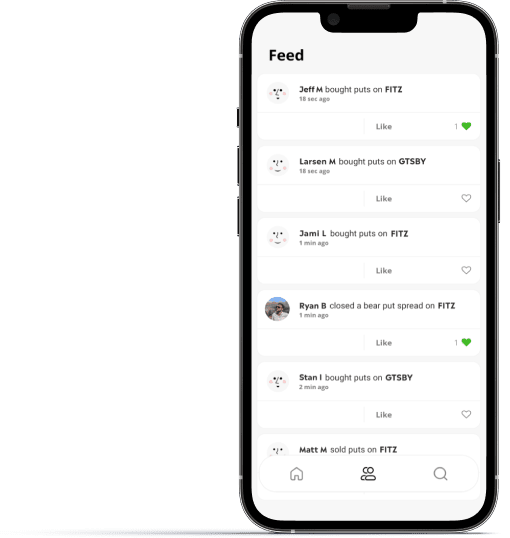

Get insights from the community

See what other traders are doing and learn from their actions.

FAQ

- How do I begin investing?

-

First, you’ll need to complete the options account application on eToro.

Once your options trading account is set up and verified, you can fund your options account.

For residents outside of NY, NV, HI, Puerto Rico, and US Virgin Islands, the easiest way is by transferring funds from your eToro stocks & crypto account. Simply navigate to Wallet in the main menu, select “Internal Transfer”, enter the amount, and click “Confirm”. It’s worth noting that deposits can take 3-5 business days to clear, but up to $1,000 will typically be credited to your account immediately as buying power.

- How do I open a trade?

-

After you’ve funded your options account, you can search for your favorite publicly traded companies. Once you find one that you like, click “Trade”, then “Trade Options”.

Choose between a call, a put, or a spread. Then, pick an expiration date and strike price for that option. You’ll be presented with the available contracts and their ask price. Choose the one that best matches your goals, review all the relevant metrics, and then click “Submit” to complete the trade.

- What are the fees for trading options?

-

There are zero commission and per-contract fees when trading options on eToro. However, nominal SEC & FINRA regulatory fees do apply to certain transactions. See full fee schedule here.

- Does the interest program cost money?

-

An operational fee of $2 per month applies to each account enrolled in the program. However, for clients with a total portfolio value of $5,000 or more across eToro accounts, eToro will pay this fee. Portfolio value criteria is based on total asset value at month end.

- Is everyone eligible for the interest offer?

-

Residents of NY, NV, HI, Puerto Rico and US Virgin Islands need to have a verified and funded eToro account in order to qualify. Click here for location-specific details.

For all other states, you’ll need to be approved for an options account on eToro to qualify for this offer. This approval is based in part on the risk tolerance and investment goals you provide during registration, which can be viewed in the Experience and Objectives section of your eToro profile. For more details, click here.

- Is there any commitment required to get 3.9% interest?

-

Residents of NY, NV, HI, Puerto Rico, and US Virgin Islands, need to have cash in their eToro account in order to enroll in the program.

For all other states, you need to have cash in your options account in order to enroll in the eToro Options High Interest Cash Program. There is no minimum equity required to opt in, and you can unenroll from the program at any time.

- How can I track the interest made on the account?

-

You can check your account statements to see the interest earned each month. Please note, there may be a delay of one month between enrollment and first payment.