Empowering a global community of investors

As a leader in social investing, eToro aims to revolutionise the way people invest while helping to grow their financial know-how

eToro is the trading and investing platform that empowers you to grow your knowledge and wealth as part of a global community.

We all want our money to work harder. Some of us are beginners, some more experienced, but we all wish that we could do better.

eToro was founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way.

We believe there is power in shared knowledge. So we’ve created an investment community built around social collaboration and investor education. Our platform is designed to provide you with the tools you need to grow your knowledge and wealth.

We can become more successful by investing together.

JAN 2007

eToro is born

Three entrepreneurs set out to disrupt the world of trading. Their mission: To make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions.

SEP 2007

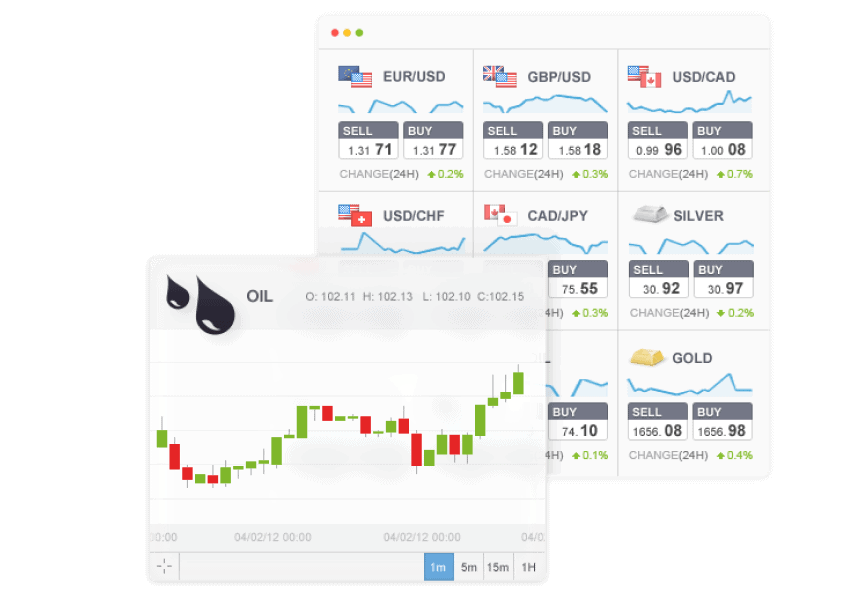

Visual FX trading platform

The first iteration of eToro: an online trading platform that makes trading easy to understand, and even fun, using graphic representations for various financial instruments.

MAY 2009

WebTrader

eToro launches its cutting-edge, intuitive trading platform, enabling anyone, anywhere to trade financial assets online. WebTrader included professional tools for both beginner and advanced traders.

JUL 2010

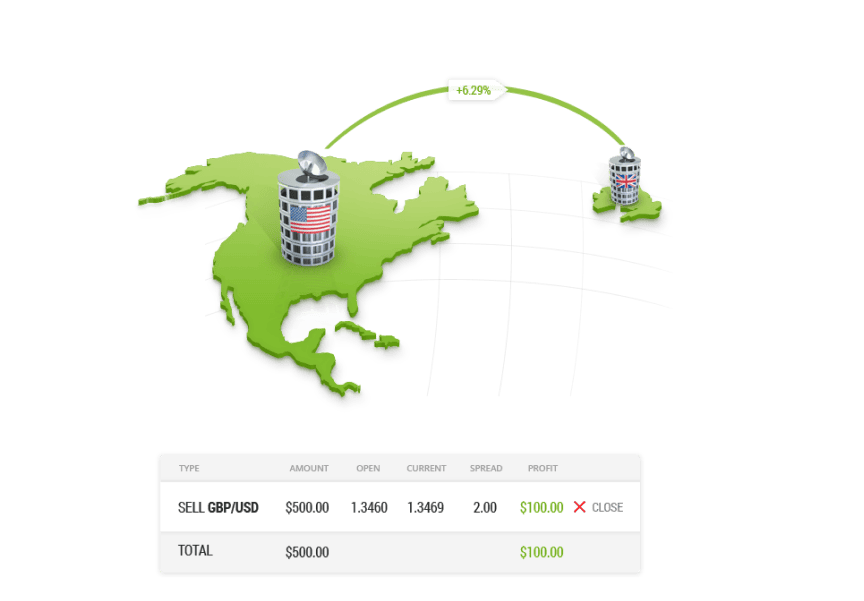

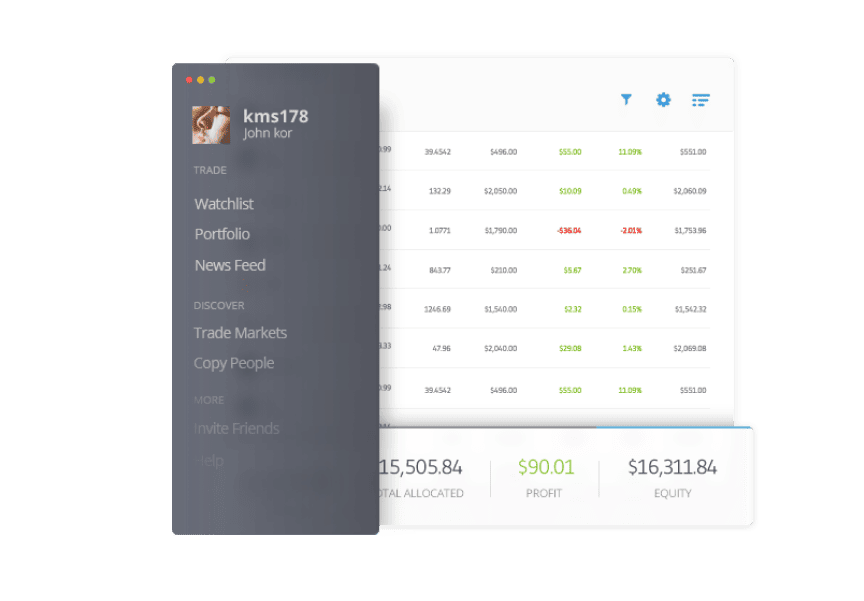

OpenBook

The world’s first social investing platform, enabling anyone in the world to join the Fintech revolution by copying other successful traders using the innovative CopyTrader™ feature. The platform attracted global attention, winning Finovate Europe Best of Show for 2011.

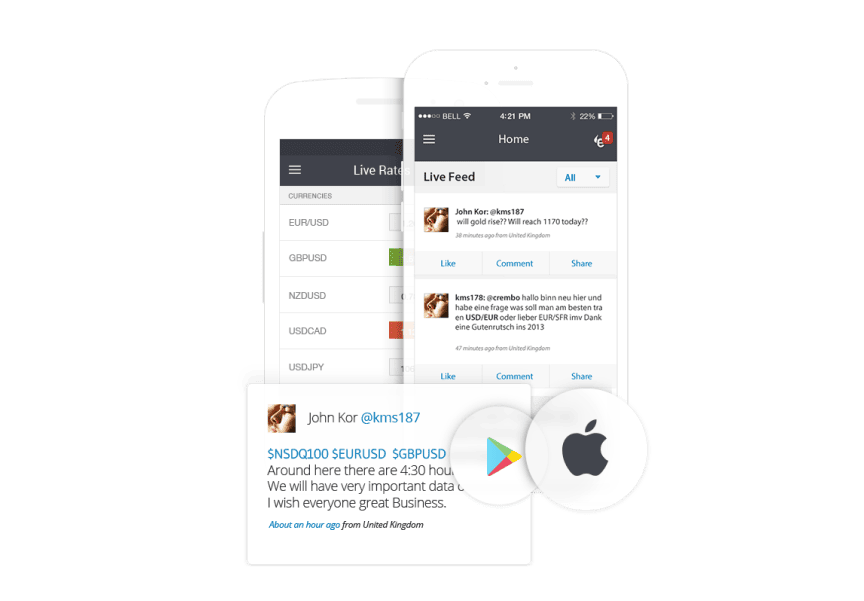

APR 2012

The eToro mobile app

Both WebTrader and OpenBook made available via a handy mobile app. Using their Apple or Android smartphone, clients could perform any action on the platform on the go.

JUL 2013

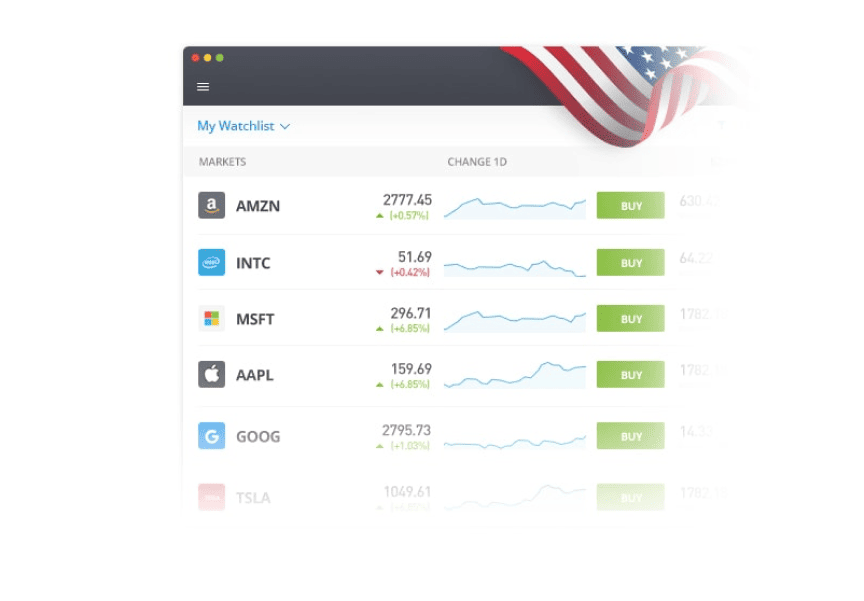

Introducing stocks

Alongside commodities, currencies and other assets on eToro, a wide selection of stocks was added (and is ever-growing), enabling traders to diversify their portfolios even further and by investing in the global stock market.

OCT 2015

The new eToro

Integrating both WebTrader’s online trading capabilities and OpenBook’s social trading features into one intuitive and innovative interface.

FEB 2016

Introducing Smart Portfolios™ (formerly known as CopyFunds)

Smart Portfolios group assets together based on a theme or strategy, such as 5G, cloud computing and renewable energy. Some use advanced algorithms, machine learning and AI to build investment strategies and curate assets to form portfolios based on market conditions.

FEB 2017

Adding crypto

After pioneering Bitcoin trading in 2013, eToro expanded its digital asset offering, enabling clients to trade and invest in ether, XRP (by Ripple Labs), Litecoin, and other popular cryptos.

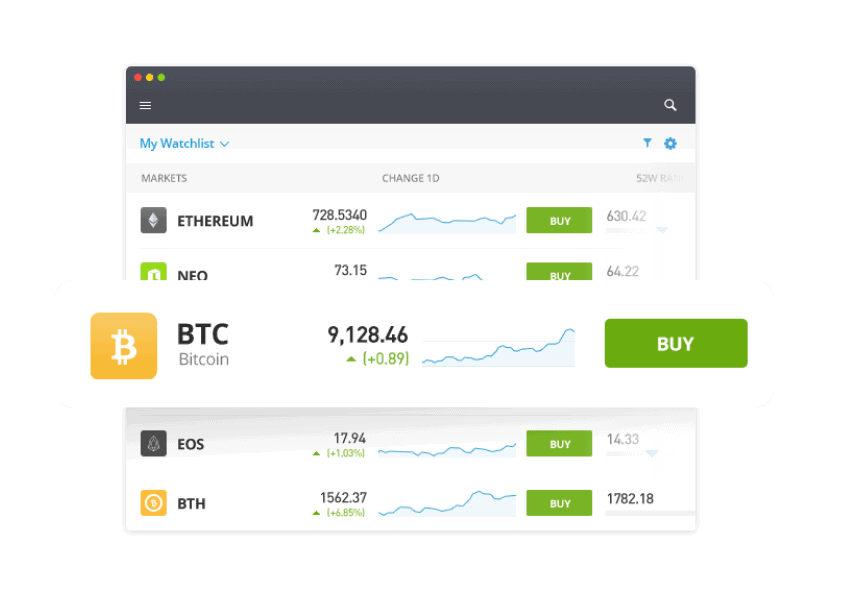

MAR 2019

US crypto platform

eToro begins Phase 1 of servicing the American market, bringing US clients our unique offering. What began as a crypto only platform has since expanded to also include stocks and options.

MAY 2019

Introducing 0% commission stocks to the world

Setting the world free of commission. Zero commission means that no additional fee has been charged on top of the market spread. eToro never charges any management, administration, or ticketing fees.

NOV 2021

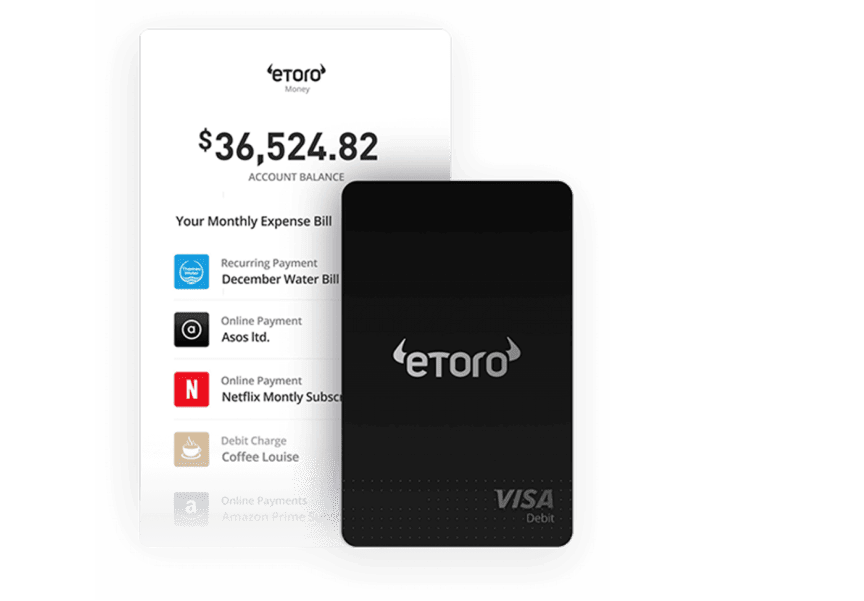

Launch GBP & EUR Accounts

The GBP and EUR accounts are a core part of our mission to offer a truly localised trading experience. With the flexibility to deposit and trade in GBP or EUR as well as USD, customers can avoid unnecessary conversion fees when investing in local assets. UK customers also receive a Visa debit card to access and spend their eToro funds with ease.

JAN 2022

Stocks, crypto, and beyond

eToro launches stock investments in the US, with fractional share investing and zero commission on an array of stocks and ETFs available to a majority of states.