Some of you may have already noticed, but last week we soft launched an extremely important new feature, the Manual Copy Stop Loss, which will enable you to predetermine the loss level at which you want to stop copying an investor.

Up until now, the Copy Stop Loss has been automatically set at 98% of allocated equity. With this new feature you will be able to set your own Stop Loss limit and manage your copy trading activity more efficiently and with greater flexibility.

This has been a long awaited addition to the CopyTrader system, and it is now finally available on eToro OpenBook. It will soon follow on our WebTrader and mobile applications.

How do I set a Copy Stop Loss?

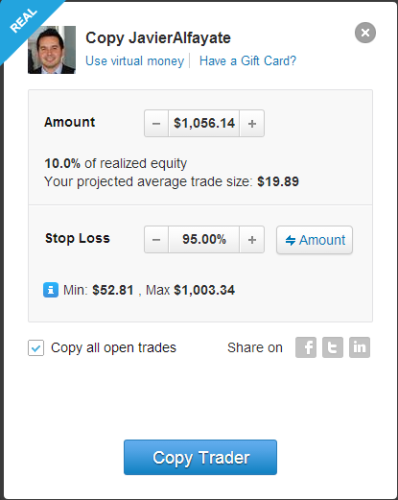

When you start copying an investor, you will now have the option to set the Stop Loss level for the copy relationship. Simply set the “Stop Loss” value (either in dollar amount or percentages) to your preference. If this copy relationship reaches the chosen Stop Loss value, you will immediately stop copying this investor.

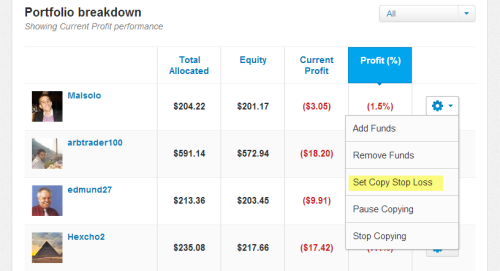

You can also set a Stop Loss for existing copy relationships, using the “Set Copy Stop Loss” feature.

Adding and Removing funds from a copy.

So what happens to the Copy Stop Loss (CSL) when you add or remove funds to/from a copy relationship?

Your predefined CSL level (in percentages) will be kept. If you decided, for example, that you don’t want to lose more than 25%, after you’ve added or removed funds from the copy, this percentage will be kept. Notice that this means that in absolute dollar amounts your CSL level will be changed (due to the fact you’ve changed to total copy amount).

But, worry not, you can always adjust your CSL levels from the “Set Copy Stop Loss” window.

Stop Loss Limitations

You can see that it’s impossible set the stop loss level for more than 95% or less than 5%. Why?

The 95% limitation is the system’s maximum allowable loss for a copy relationship, on the other hand, setting the CSL level for less than 5% bears the risk of triggering the Stop Loss immediately. These limitations may be subject to change, in the future.

Use it Wisely

Copy Stop Loss is an important tool in managing your portfolio risk. It allows you to invest larger amounts in Popular Investors while keeping the risk of losing money limited to a specific level determined by you.

What are you still doing here? Go set Copy Stop Loss limits for all your copied investors via the eToro OpenBook. Then let us know what you think about this new feature in the comments below.