Ever wonder what the best investors in the world are investing in? You’re probably thinking that their portfolios are full of stocks you never heard of, opportunities that only the people in those elite circles know about.

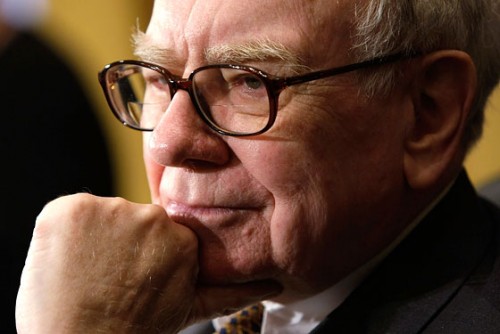

Well, looking at Warren Buffet’s portfolio, nothing could be farther from the truth.

In fact, the greatest investor of all time, is investing pretty much in the same stocks that eTorians invest in every day.

Take a look at the top 10 stocks in Buffett’s portfolio (courtesy of Stockpickr):

We can see that Buffett is expecting to cash in on the rebound of the financial industry, as can be seen from his heavy investments in Wells Fargo (constituting over 20% of his portfolio!) and American Express.

In addition, Buffet’s portfolio includes classic value investments such as Coca-Cola, Wal-Mart and Exxon Mobil. Considering the fact that Buffett is known for value investing, this comes as no surprise.

The major curve-ball among these top 10 is his investment in DirecTV, which has been bought out by AT&T just last Friday. Rumors of the merger had been circulating for months, which makes this investment very untypical for a solid value investor like Buffett, who was probably trying to cash in on the stock and cash exchange offered by AT&T as a result of the merger.

We can all take a lesson here from Mr. Buffett: even if you’re famous for a certain investment strategy doesn’t mean that you have to let a lucrative opportunity pass you by, just because it’s not in line with your general investment style.